Taiwan Semiconductor Manufacturing Company (TSMC) has once again secured its position among the world's top 10 most valuable companies. This resurgence is fueled by the current wave of optimism surrounding artificial intelligence (AI) advancements within the tech industry, which has propelled its stock to unprecedented levels.

According to a Bloomberg report, TSMC shares experienced a significant rally last week, surging by 14%. This surge resulted in a record market capitalization for the chipmaker. Although a slight decrease of 2% was observed in early trading on Monday, March 11th, the company's market capitalization remained substantial at $634 billion.

The report highlights that this minor decline did not significantly impact the company's overall standing, as its market share remains higher than that of Broadcom.

Analysts at leading financial institutions such as Morgan Stanley and JPMorgan Chase & Co. anticipate further growth for the semiconductor giant. TSMC boasts prominent clients including Apple, Nvidia, and Qualcomm. The company's prospects are bolstered by increasing revenue related to AI and its strong pricing power.

Morgan Stanley analysts, including Charlie Chan, noted in a recent report that "Generative AI semi is an obvious growth driver for TSMC." They also pointed out that the company's ongoing overseas expansion efforts contribute to mitigating geopolitical concerns.

TSMC reported a 9.4% increase in revenue for the first two months of 2024. This growth is attributed to the rising demand for high-end chips, driven by the surge in AI-related activities.

Nvidia has also experienced a significant boost this year due to the excitement surrounding generative AI.

Over the past month, Nvidia's stock price has increased by more than 20%. Looking at a broader timeframe, the stock has risen over 90% in the last six months. Furthermore, over the past year, Nvidia's stock price has jumped from $234.36 per share to $875.28 per share, marking an impressive 275% increase.

Newer articles

Older articles

Vitamin D Could Slash Tooth Decay Risk by 50%, Study Suggests

Vitamin D Could Slash Tooth Decay Risk by 50%, Study Suggests

Indian Cricket Star Mukesh Kumar and Wife Divya Singh Announce Birth of Son

Indian Cricket Star Mukesh Kumar and Wife Divya Singh Announce Birth of Son

Shubman Gill's Captaincy Under Fire: Bold Calls Needed After England Test Defeat

Shubman Gill's Captaincy Under Fire: Bold Calls Needed After England Test Defeat

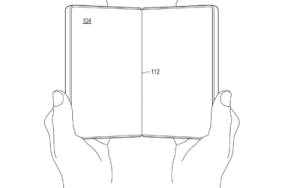

Microsoft Aims for Foldable Redemption with Novel Hinge Design to Rival iPhone and Android

Microsoft Aims for Foldable Redemption with Novel Hinge Design to Rival iPhone and Android

Popular Finance YouTuber's Account Hacked, Bitcoin Scam Promoted: Security Lessons Learned

Popular Finance YouTuber's Account Hacked, Bitcoin Scam Promoted: Security Lessons Learned

Esha Gupta Breaks Silence on Hardik Pandya Romance Rumors: 'We Were Just Talking'

Esha Gupta Breaks Silence on Hardik Pandya Romance Rumors: 'We Were Just Talking'

Hollywood's Love Affair with India: Iconic Film Locations Revealed

Hollywood's Love Affair with India: Iconic Film Locations Revealed

Rishabh Pant Aims to Surpass Virat Kohli in Test Century Tally During England Series

Rishabh Pant Aims to Surpass Virat Kohli in Test Century Tally During England Series

Prithvi Shaw Credits Sachin Tendulkar's Guidance for Career Revival After Setbacks

Prithvi Shaw Credits Sachin Tendulkar's Guidance for Career Revival After Setbacks

Ashada Gupt Navratri 2025: Unveiling Dates, Timings, Significance & Secret Rituals

Ashada Gupt Navratri 2025: Unveiling Dates, Timings, Significance & Secret Rituals